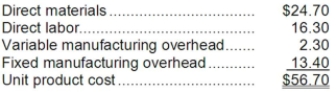

Foster Company makes 20,000 units per year of a part it uses in the products it manufactures. The unit product cost of this part is computed as follows:  An outside supplier has offered to sell the company all of these parts it needs for $51.80 a unit. If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand. The additional contribution margin on this other product would be $44,000 per year.

An outside supplier has offered to sell the company all of these parts it needs for $51.80 a unit. If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand. The additional contribution margin on this other product would be $44,000 per year.

If the part were purchased from the outside supplier, all of the direct labor cost of the part would be avoided. However, $5.10 of the fixed manufacturing overhead cost being applied to the part would continue even if the part were purchased from the outside supplier. This fixed manufacturing overhead cost would be applied to the company's remaining products.

Required:

a. How much of the unit product cost of $56.70 is relevant in the decision of whether to make or buy the part?

b. What is the net total dollar advantage (disadvantage) of purchasing the part rather than making it?

c. What is the maximum amount the company should be willing to pay an outside supplier per unit for the part if the supplier commits to supplying all 20,000 units required each year?

Definitions:

Bipolar Disorder

A psychological disorder marked by severe fluctuations in mood, ranging from manic or hypomanic episodes to depressive lows.

Manic Phase

A period of abnormally elevated mood, energy and activity levels, often associated with bipolar disorder.

Poor Appetite

A reduced desire to eat, often resulting from psychological or physical illness.

Huge Contributions

Large or significant additions, achievements, or efforts that have a major impact on a field or area.

Q3: In setting a transfer price, which of

Q36: How much fixed Maintenance Department cost should

Q41: The direct labor standards at Hebden Corporation

Q42: The net present value of the entire

Q70: The materials quantity variance for November is:<br>A)$3,290

Q82: Pierce Corporation uses a standard cost system

Q88: The net present value of a proposed

Q125: Hal currently works as the fry guy

Q144: The income tax expense in year 3

Q144: A materials price variance is unfavorable if