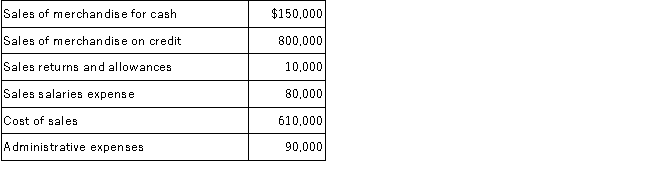

The following data were taken from the records of Lilo Corporation for the year ended December 31, 2016 before any adjustment for bad debt expense:  The following items have not been included in above amounts:

The following items have not been included in above amounts:

Estimated bad debt expense is 1% of credit sales.

The income tax rate is 35%.

10,000 of shares of common stock are outstanding.

Required:

A.Calculate the bad debt expense.

B.Prepare a multiple-step income statement (including gross profit, income before income taxes, and earnings per share).

Definitions:

Two-year Period

A specific timeframe often referenced in tax or legal contexts, which might relate to limitations, qualifications, or assessments.

Involuntary Conversion

A forced exchange of property or assets, often due to theft or natural disaster, that may have tax implications.

Two Years

A time period equal to 24 months or 730 days, often cited in various contexts such as investment holding periods for tax purposes.

Personal-use Asset

An asset primarily used for personal enjoyment or living purposes, not for business or investment aims.

Q7: The financial statements of Franklin Company contained

Q14: Which of the following accounts normally have

Q15: Phipps Company borrowed $25,000 cash on October

Q26: Which of the following is correct?<br>A)If a

Q34: Rice Corporation's attorney has provided the following

Q36: The accrual of interest on a short-term

Q68: Maxim Corp. has provided the following information

Q81: On December 31, 2016, Madison Company prepared

Q92: A transaction may be an exchange of

Q97: Of the following, which is not a