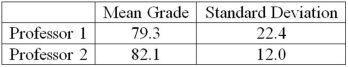

Two accounting professors decided to compare the variance of their grading procedures. To accomplish this, they each graded the same 10 exams, with the following results:  What are the degrees of freedom for the numerator of the F ratio?

What are the degrees of freedom for the numerator of the F ratio?

Definitions:

Allowable Depreciation

The allowable tax deduction for the reduction in value of a tangible asset over its useful life, as determined by tax regulations.

MACRS Tables

Depreciation schedules in the Modified Accelerated Cost Recovery System allowing for faster asset depreciation in the earlier years of the asset's life.

Depreciation Expense

The allocation of the cost of a tangible asset over its useful life.

Double-Declining-Balance

A method of accelerated depreciation which doubles the normal depreciation rate.

Q22: The researcher must decide on the level

Q28: Hypothesis testing is a procedure that uses

Q44: A random sample of 40 companies with

Q45: For people released from prison, the following

Q50: In multiple regression analysis, a residual is

Q74: To collect a sample, a population is

Q76: When testing for differences between treatment means,

Q85: To conduct a test of hypothesis with

Q89: In a contingency table, multiplying the row

Q120: What statement do we make that determines