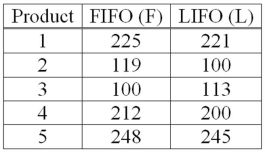

Accounting procedures allow a business to evaluate its inventory costs based on two methods: LIFO (Last In First Out) or FIFO (First In First Out) . A manufacturer evaluated its finished goods inventory (in $000s) for five products with the LIFO and FIFO methods. To analyze the difference, they computed (FIFO - LIFO) for each product. Based on the following results, does the LIFO method result in a lower cost of inventory than the FIFO method?  What is the value of calculated t?

What is the value of calculated t?

Definitions:

Factory Overhead Cost

Indirect costs incurred during the manufacturing process, not directly associated with the production of goods, like utilities and rent for the manufacturing space.

Materials

The physical substances or components used in the production of goods.

Factory Overhead

Costs associated with the manufacturing process that cannot be directly traced to a specific product, including utilities, depreciation, and maintenance of equipment.

Product Cost

The total cost associated with making or acquiring a product, including raw materials, labor, and overhead expenses.

Q2: Recently, students in a marketing research class

Q9: The critical t statistic for the alternative

Q12: The _ method determines the equation of

Q19: A sample of 250 adults tried the

Q39: In multiple regression analysis, the _ scale

Q54: A Type II error is the probability

Q89: If we are testing for the difference

Q92: The relationship between interest rates as a

Q99: If we are testing for the difference

Q104: If the size of a sample equals