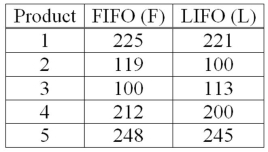

Accounting procedures allow a business to evaluate its inventory costs based on two methods: LIFO (Last In First Out) or FIFO (First In First Out) . A manufacturer evaluated its finished goods inventory (in $000s) for five products with the LIFO and FIFO methods. To analyze the difference, they computed (FIFO - LIFO) for each product. Based on the following results, does the LIFO method result in a lower cost of inventory than the FIFO method?  What is the decision at the 5% level of significance?

What is the decision at the 5% level of significance?

Definitions:

Cost-Cutting Measure

Strategies or actions implemented by a company to reduce its expenses and improve profitability.

Shareholder Value

The financial worth that a company delivers to its shareholders, often measured by stock price appreciation and dividend payouts.

Firms Fail

The situation where businesses are unable to continue operations due to financial problems, market competition, or poor management.

Due Diligence

The comprehensive appraisal of a business or individual prior to signing a contract, or an act with a certain standard of care.

Q6: Two accounting professors decided to compare the

Q7: We are interested in knowing if the

Q19: The proportion of the area under a

Q25: A(n) _ hypothesis test is indicated if

Q40: The variance inflation factor can be used

Q95: A national manufacturer of ball bearings is

Q97: Using the following information: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4677/.jpg" alt="Using

Q100: Stepwise regression analysis is a method that

Q102: A chart that shows the relationship between

Q109: The regression equation is Ŷ = 30