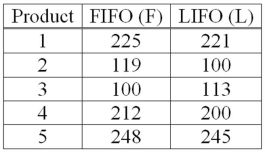

Accounting procedures allow a business to evaluate its inventory costs based on two methods: LIFO (Last In First Out) or FIFO (First In First Out) . A manufacturer evaluated its finished goods inventory (in $000s) for five products with the LIFO and FIFO methods. To analyze the difference, they computed (FIFO - LIFO) for each product. Based on the following results, does the LIFO method result in a lower cost of inventory than the FIFO method?  What is the value of calculated t?

What is the value of calculated t?

Definitions:

Northwest-Corner Method

A technique used in transportation and logistics to find an initial feasible solution for the Transportation Problem by starting at the northwest corner of a cost matrix and moving south and east to allocate shipments.

Source A

A specific origin from which materials, services, or information are obtained.

Source B

This does not appear to represent a standard key term within common academic or technical contexts. Therefore, NO.

Capacity

The maximum amount that something can contain or produce, often used in reference to production and manufacturing facilities, systems, and services.

Q9: The critical t statistic for the alternative

Q11: If the null hypothesis is µµ ≥

Q45: The Intelligence Quotient (IQ) test scores for

Q50: In multiple regression analysis, a residual is

Q53: For a two-tailed hypothesis test, the computed

Q59: A population consists of the following four

Q68: When applying the stepwise regression technique, _

Q84: As the size of the sample increases,

Q90: The test statistic used to compare two

Q124: Records on a fleet of trucks reveal