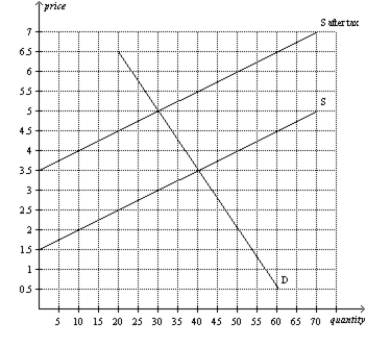

Figure 6-22

-Refer to Figure 6-22.Suppose the same supply and demand curves apply,and a tax of the same amount per unit as shown here is imposed.Now,however,the buyers of the good,rather than the sellers,are required to pay the tax to the government.After the buyers pay the tax,relative to the case depicted in the figure,the burden on buyers will be

Definitions:

Gross Profit

The financial gain calculated by subtracting the cost of goods sold from total revenue.

Inventory

The total amount of goods and materials held in stock by a business, shop, or warehouse.

Administrative Expenses

Ongoing expenses associated with the general operation of a business, such as office supplies, salaries of non-sales personnel, and utilities.

Income Statement

A financial statement that shows a company's revenues and expenses over a specific period, usually a year or a quarter, highlighting the net profit or loss.

Q96: Suppose the government imposes a 20-cent tax

Q261: Refer to Figure 6-23. How much tax

Q377: Chuck would be willing to pay $20

Q416: The burden that results from a tax

Q472: A binding price floor may not help

Q519: Suppose that the demand for picture frames

Q536: Brock is willing to pay $400 for

Q545: Refer to Table 6-4. Following the imposition

Q618: Refer to Figure 6-25. As the figure

Q628: Refer to Figure 6-25. Suppose the same