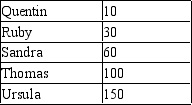

Table 7-16

The following table represents the costs of five possible sellers.

Seller Cost ($)

-Refer to Table 7-16. If each producer has one unit available for sale, and if the market equilibrium price is $80 per unit, how much is the total producer surplus in this market?

Definitions:

Provincial Tax Brackets

These refer to the range of income segments taxed at different rates by provincial governments in countries like Canada, where taxation powers are shared between federal and provincial authorities.

Net Working Capital

The difference between a company’s current assets and its current liabilities, indicating the liquidity of the business.

Current Assets

Assets that a company expects to convert into cash within one year or one business cycle, whichever is longer.

Current Liabilities

Short-term financial obligations or debts of a company, typically due within one year.

Q28: If the price of oak lumber increases,

Q32: Refer to Table 6-6. In this market,

Q49: Taxes cause deadweight losses because taxes<br>A) reduce

Q59: Refer to Figure 8-6. When the tax

Q150: Refer to Figure 7-13. If the equilibrium

Q175: Discrimination is an example of a rationing

Q273: Relative to a situation in which gasoline

Q340: Refer to Figure 7-24. At equilibrium, total

Q442: Refer to Figure 6-35. A price ceiling

Q467: The goal of the minimum wage is