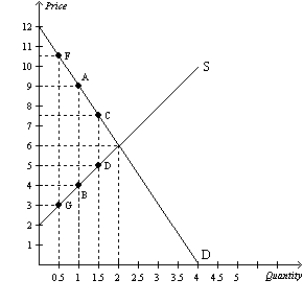

Figure 8-19

The vertical distance between points A and B represents the original tax.

-Refer to Figure 8-19.If the government changed the per-unit tax from $5.00 to $7.50,then the price paid by buyers would be $10.50,the price received by sellers would be $3,and the quantity sold in the market would be 0.5 units.Compared to the original tax rate,this higher tax rate would

Definitions:

Cash Budget

A financial plan that estimates cash inflows and outflows over a specific period, often used to assess liquidity and cash requirements.

Financing Section

A part of the cash flow statement that shows the net flows of cash used to fund the company’s capital expenditures and financial investments.

Budgeted Income Statement

The Budgeted Income Statement is a financial forecast that projects a company’s revenues, expenses, and net income for a specific period.

Accrual Basis

An accounting method where revenue and expenses are recorded when they are earned or incurred, regardless of when cash is exchanged.

Q22: Assume, for England, that the domestic price

Q39: Refer to Figure 8-1. Suppose the government

Q131: Refer to Figure 9-10. The area bounded

Q224: Suppose a tax is imposed on the

Q268: Both tariffs and import quotas<br>A) increase the

Q375: Refer to Figure 8-5. The price that

Q435: Suppose Rebecca needs a dog sitter so

Q462: Consumer surplus is the amount a buyer

Q504: Refer to Figure 8-8. One effect of

Q543: The lower the price, the lower the