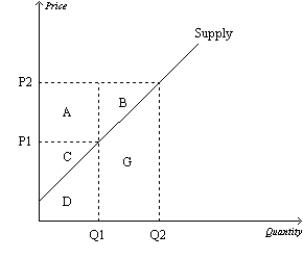

Figure 7-15

-Refer to Figure 7-15.When the price is P1,producer surplus is

Definitions:

Sales Tax

A tax on sales or on the receipts from sales, typically added to the purchase price by the seller.

Assessed Valuations

The dollar value assigned to a property for purposes of measuring applicable taxes.

Overhead Expenses

Indirect costs related to running a business that are not directly tied to production, including rent, utilities, and administrative salaries.

Assessed Valuation

Assessed Valuation is the dollar value assigned to a property for purposes of taxation by a public authority.

Q26: The tax burden will fall most heavily

Q79: Refer to Figure 7-3. When the price

Q87: Refer to Figure 7-8. If the government

Q95: Refer to Figure 8-5. After the tax

Q145: A tax on sellers increases the quantity

Q170: Refer to Figure 8-2. The loss of

Q233: Refer to Figure 7-24. If the government

Q363: A binding price floor may not help

Q413: Suppose that the demand for picture frames

Q428: The government's benefit from a tax can