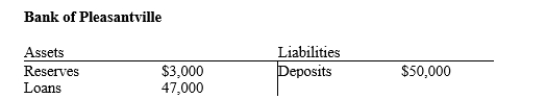

Table 29-6.

-Refer to Table 29-6. From the table it follows that the Bank of Pleasantville operates in a

Definitions:

Deferred Consumption Risk

The risk associated with postponing consumption today in order to invest, with the potential of not having enough resources in the future.

Liquidity Risk

The risk that an entity will not be able to meet its short-term financial obligations due to the inability to quickly convert assets to cash without significant loss.

Maturity Risk

The risk that the value of a financial instrument will change due to a change in the absolute level of interest rates, sometimes referred to as interest rate risk.

Inflation

The rate at which the general level of prices for goods and services is rising, eroding purchasing power.

Q19: When the Consumer Price Index increases from

Q24: If the federal funds rate were above

Q86: Minimum wage laws, labor unions, and efficiency

Q187: The manager of the bank where you

Q189: Bank capital is<br>A) the machinery, structures, and

Q244: Structural unemployment is often thought to explain

Q249: What problems arise in interpreting unemployment data?

Q333: Suppose the money supply tripled, but at

Q417: According to the classical dichotomy, which of

Q469: When the Fed purchases $1000 worth of