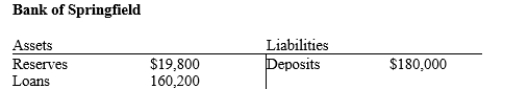

Table 29-7.

-Refer to Table 29-7. If the Fed requires a reserve ratio of 6 percent, then what quantity of excess reserves does the Bank of Springfield now hold?

Definitions:

CAPM

Short for Capital Asset Pricing Model, a financial model that describes the relationship between systematic risk and expected return for assets.

Required Rates of Return

The minimum annual percentage earnings needed from an investment to compensate for its risk, serving as a benchmark for evaluating potential investments.

Standard Deviations

A statistical measure of the dispersion or variability of a set of data points or investment returns from their average value.

Expected Return

The weighted average of the probable returns of an investment, calculated based on past performance or statistical analyses.

Q57: When unions raise wages in one part

Q76: The unemployment that results from the quantity

Q108: On a bank's T-account, which are part

Q163: If the value of a dollar falls,

Q176: Changes in the composition of demand among

Q207: The manager of the bank where you

Q229: Currently, bank runs are a major problem

Q350: Refer to Figure 30-1. If the money

Q436: If an economy uses silver as money,

Q467: Suppose over some period of time the