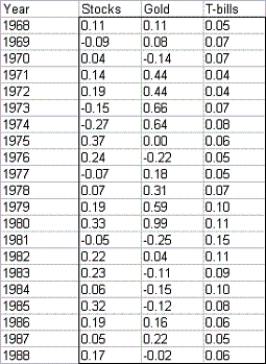

The risk index of an investment can be obtained by taking the absolute values of percentage changes in the value of the investment for each year and averaging them.Suppose you are trying to determine what percentage of your money you should invest in T-bills,gold,and stocks.The table below lists the annual returns (percentage changes in value)for these investments for the years 1968-1988.  Let the risk index of a portfolio be the weighted average of the risk indexes of these investments,where the weights are the fractions of your money assigned to the investments.Suppose that the amount of each investment must be between 20% and 50% of the total invested.You would like the risk index of your portfolio to equal 0.15,and your goal is to maximize the expected return on your portfolio.Determine the maximum expected return on your portfolio,subject to the stated constraints.Use the average return earned by each investment during the years 1968-1988 as your estimate of expected return.

Let the risk index of a portfolio be the weighted average of the risk indexes of these investments,where the weights are the fractions of your money assigned to the investments.Suppose that the amount of each investment must be between 20% and 50% of the total invested.You would like the risk index of your portfolio to equal 0.15,and your goal is to maximize the expected return on your portfolio.Determine the maximum expected return on your portfolio,subject to the stated constraints.Use the average return earned by each investment during the years 1968-1988 as your estimate of expected return.

Definitions:

Power Line Carrier

A communication method that uses electrical distribution lines for transmitting data over long distances.

Multiplexing

Used to describe data bus systems in which two or more controllers communicate with each other; reduces system hard wire and components while optimizing chassis performance.

Data Bus

Multiplex backbone consisting of a twisted wire pair.

Non-Dedicated Wire

A wire within an electrical system that is not reserved for a single specific use or function.

Q11: The constraint can be placed on a

Q45: A confidence interval constructed around a point

Q46: (A)The three stock returns are highly correlated.The

Q47: The chi-square test for normality makes a

Q54: _ are the result of formatting disorganized

Q63: Suppose that the demand for cars is

Q70: One important special use of bounded distributions

Q81: The three parameters required to specify a

Q99: Suppose we compare the difference between the

Q103: What are the chances the firm could