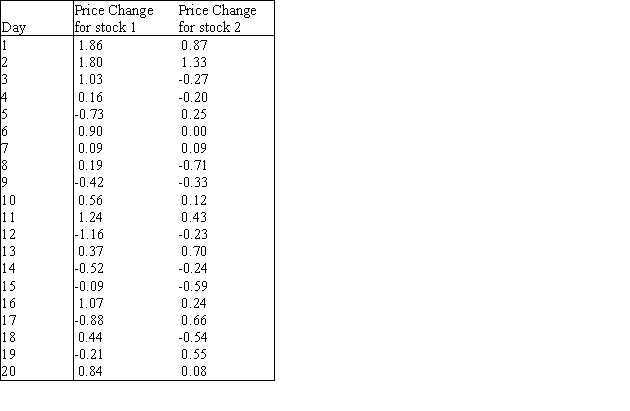

An investor wants to compare the risks associated with two different stocks.One way to measure the risk of a given stock is to measure the variation in the stock's daily price changes.The investor obtains a random sample of 20 daily price changes for stock 1 and 20 daily price changes for stock 2.These data are shown in the table below.Show how this investor can compare the risks associated with the two stocks by testing the null hypothesis that the variances of the stocks are equal.Use  = 0.10 and interpret the results of the statistical test.

= 0.10 and interpret the results of the statistical test.

Definitions:

Mail Merge Wizard

A tool in word processing software that helps users automate the creation of documents by merging a template with a database of information.

Update Labels

Update Labels involve modifying or refreshing the identifiers used for organizing or managing elements in a software system or database.

Match Fields

The process of aligning or correlating fields from two or more databases or sources based on common identifiers, often used in data integration and matching algorithms.

Mail Merge Wizard

A step-by-step guide tool in word processing software that helps users create personalized documents by merging a template with a data source.

Q9: The Durbin-Watson statistic can be used to

Q17: Cross-sectional data are usually data gathered from

Q34: In order to construct a confidence interval

Q43: (A)Summarize the findings of the stepwise regression

Q51: The interval estimate 18.5 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2053/.jpg" alt="The

Q60: Infeasibility refers to the situation in which

Q65: Discuss how the company's optimal production schedule

Q86: Correlogram is a bar chart of autocorrelation

Q99: What is the probability that exactly two

Q109: The joint probabilities shown in a table