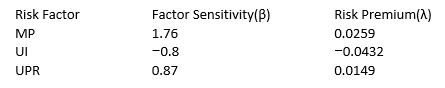

The table below provides factor risk sensitivities and factor risk premia for a three factor model for a particular asset where factor 1 is MP the growth rate in US industrial production, factor 2 is UI the difference between actual and expected inflation, and factor 3 is UPR the unanticipated change in bond credit spread.  Calculate the expected excess return for the asset.

Calculate the expected excess return for the asset.

Definitions:

Tangible Objects

Physical items that can be seen, touched, and measured, as opposed to abstract concepts or virtual items.

Organizational Culture

A set of shared values, beliefs, and practices that characterizes an organization and guides its members' behaviors.

Cultural Values

The core principles and ideals upon which an entire community exists and functions, shaping behavior and setting standards for what is important.

Subcultures

Groups within a larger culture that have their own distinct values, behaviors, and traditions.

Q3: Which of the following is not true

Q3: How many years does it take to

Q6: Consider the following information on put and

Q6: If you expect stock volatility to rise

Q8: In the absence of arbitrage opportunities, the

Q8: Semivariance, when applied to portfolio theory, is

Q13: Describe the auditor's use of performance indicators

Q14: All of the following are normal characteristics

Q17: Explain the three forms of attestation.

Q21: You are long 5 eurodollar futures contracts.