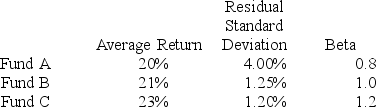

You want to evaluate three mutual funds using the information ratio measure for performance evaluation. The risk-free return during the sample period is 6%, and the average return on the market portfolio is 19%. The average returns, residual standard deviations, and betas for the three funds are given below.

The fund with the highest information ratio measure is

Definitions:

Hedonic Treadmill

The theory suggesting that people consistently return to a relatively stable level of happiness despite major positive or negative events or life changes.

Neoclassical Assumptions

The foundational premises of neoclassical economics, such as rational behavior, market equilibrium, and utility maximization.

Behavioral Economists

Specialists examining the effects of psychological, cognitive, emotional, cultural, and social components on the economic decision-making of individuals and institutions.

Nudges

Subtle policy shifts or design changes that steer people's behavior in predictable ways without forbidding any options or significantly changing economic incentives.

Q6: What is an example of cultural divergence?<br>A)

Q11: An employee has an average wage of

Q22: In a particular year, Razorback Mutual Fund

Q30: Risk-adjusted mutual fund performance measures have decreased

Q32: Exchange-traded stock options expire on the _

Q51: The following data are available relating to

Q57: The _ contract dominates trading in stock-index

Q62: Research conducted by Rubinstein (1994) suggests that

Q65: Assuming positive basis and negligible borrowing cost,

Q70: Bill Jones inherited 5,000 shares of stock