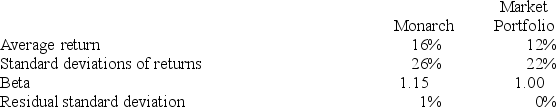

The following data are available relating to the performance of Monarch Stock Fund and the market portfolio:

The risk-free return during the sample period was 4%.

What is the information ratio measure of performance evaluation for Monarch Stock Fund?

Definitions:

Risky Securities

Financial instruments that carry a higher risk of loss, often associated with higher potential returns.

T-Bill

Short for Treasury Bill, this is a short-term government security issued at a discount from par value and pays no interest.

Risk Tolerance

The degree of variability in investment returns that an investor is willing to withstand, related to one's financial situation, investment objectives, and psychological comfort.

Risky Asset

An asset that carries a significant degree of risk of losing value, but also offers a potential for higher returns compared to safer investments.

Q2: What direct methods of control do expatriates

Q3: Why is self-initiated global mobility increasingly popular?<br>A)

Q4: Hedge fund managers are compensated by _.<br>A)

Q6: The manager of Quantitative International Fund uses

Q11: The difference between market-neutral and long-short hedges

Q11: Todd Mountain Development Corporation is expected to

Q47: The financial statements of Burnaby Mountain Trading

Q58: A stock with a stock and exercise

Q83: A futures call option provides its holder

Q90: Westsyde Tool Company is expected to pay