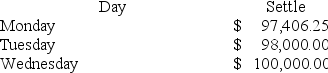

On Monday morning you sell one June T-bond futures contract at $97,843.75. The contract's face value is $100,000. The initial margin requirement is $2,700, and the maintenance margin requirement is $2,000 per contract. Use the following price data to answer the following questions.

The cumulative rate of return on your investment after Wednesday is a ________.

Definitions:

Profit-Maximizing

The process of increasing the financial gain of an entity as much as possible through various strategies and decisions.

Market Price

The present rate at which a service or asset is available for purchase or sale in the market.

Perfectly Competitive

A market structure where many firms offer a homogeneous product, there are no barriers to entry or exit, and every company is a price taker.

Total Cost

The total expense of manufacturing, comprising both constant and fluctuating costs.

Q13: You purchase one MBI March 120 put

Q25: A _ is a private investment pool

Q34: You want to evaluate three mutual funds

Q39: The collapse of the Long Term Capital

Q40: The average country equity market share is<br>A)

Q41: ART has come out with a new

Q54: Futures contracts are said to exhibit the

Q59: You are convinced that a stock's price

Q63: A one-dollar increase in a stock's price

Q67: A portfolio manager's ranking within a comparison