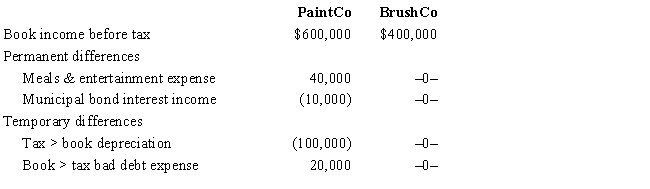

PaintCo Inc., a domestic corporation, owns 100% of BrushCo Ltd., an Irish corporation. Assume that the U.S. corporate tax rate is 35% and the Irish rate is 15%. PaintCo is permanently reinvesting BrushCo's earnings outside the United States under ASC 740-30 (APB 23). The corporations' book income, permanent and temporary book-tax differences, and current tax expense are reported as follows. There is no valuation allowance, and the effective tax rates do not change. Determine PaintCo's total tax expense reported on its GAAP financial statements, its current tax expense (benefit), and its deferred tax expense (benefit).

Definitions:

Claim

A formal request or demand for payment or another benefit, based on the terms of an insurance policy or contract.

Trust Fund

A legal entity created to hold assets for the benefit of specific individuals or organizations, managed by a trustee.

Hold-Back

The retention of a part of the contract price by the owner as required under construction lien legislation to ensure payment of subcontractors and suppliers of materials.

Suppliers Of Goods And Services

Entities or individuals that provide the market with products or perform tasks as a business.

Q1: In the case of interest income from

Q15: On June 1, 2016, Norm leases a

Q15: The real rate of return can be

Q16: Tom participates for 100 hours in Activity

Q22: The fact that the accounting method the

Q36: Investigation of a business unrelated to one's

Q52: Two years ago, Gina loaned Tom $50,000.

Q66: Dell Computer Corporation has receivables of $2.5

Q98: Bjorn owns a 60% interest in an

Q113: If the amount of the insurance recovery