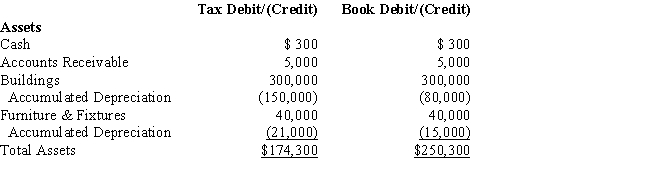

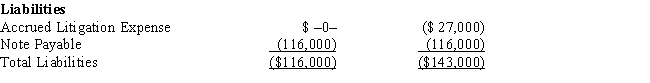

Black, Inc., is a domestic corporation with the following balance sheet for book and tax purposes at the end

of the year. Assume a 35% corporate tax rate and no valuation allowance.

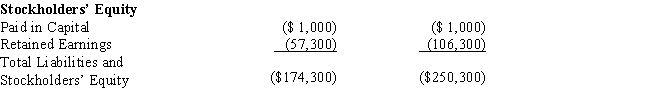

Black, Inc.'s, gross deferred tax assets and liabilities at the beginning of Black's year are listed below.

Black, Inc.'s, book income before tax is $6,000. Black records two permanent book-tax differences.

It earned $250 in tax-exempt municipal bond interest, and it incurred $500 in nondeductible meals

and entertainment expense. Determine the change in Black's deferred tax assets for the current year.

Definitions:

Claiming Habits

Patterns or tendencies of individuals or groups in asserting or establishing their rights, entitlements, or possessions, often in legal or business contexts.

Defined Contribution Plan

A type of retirement plan in which the employer, employee, or both make contributions on a regular basis, but the final benefit received by the employee depends on the plan's investment performance.

Length of Service

The duration of time an employee has worked for a particular employer, often affecting their eligibility for certain benefits or recognition.

Vesting

A provision in employer-provided retirement plans that gives workers the right to a pension after a specified number of years of service.

Q8: The golden rule is an example of:<br>A)

Q10: Incentives for ethical behaviour are:<br>A) market forces.<br>B)

Q16: It is impossible for the nominal rate

Q17: Roger owns and actively participates in the

Q18: Accounting profits include non-cash revenues (e.g., prepaid

Q51: Blue Corporation incurred the following expenses in

Q80: All of a taxpayer's tax credits relating

Q86: South, Inc., earns book net income before

Q95: Carl, a physician, earns $200,000 from his

Q120: A taxpayer may elect to use the