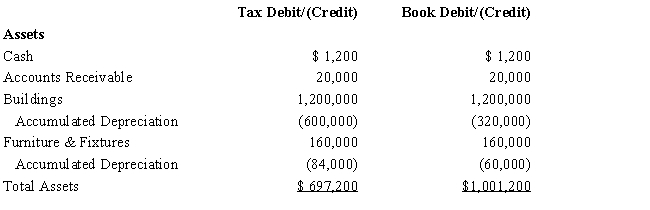

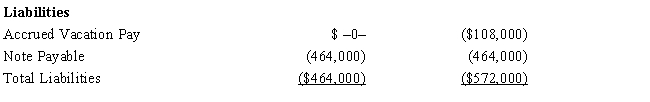

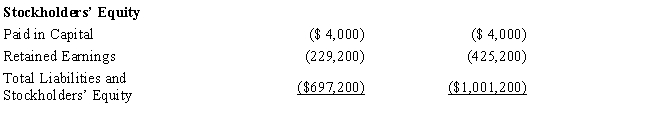

Amelia, Inc., is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year. Assume a 34% corporate tax rate and no valuation allowance.

Amelia, Inc.'s, gross deferred tax assets and liabilities at the beginning of Amelia's year are listed below.

Amelia, Inc.'s, book income before tax is $25,200. Amelia records two permanent book-tax differences.

It earned $1,000 in tax-exempt municipal bond interest and $1,840 in nondeductible meals and

entertainment expense. Determine the change in Amelia's deferred tax liabilities for the current year.

Definitions:

Participant

An individual who actively takes part in an activity, process, or event.

Coach

An individual who supports, trains, and guides others in achieving their personal or professional goals.

Team Skill

Composite of abilities and competencies that members of a team possess and utilize to achieve collaborative tasks and goals effectively.

Support Groups

Gatherings of people who share a common condition or problem, who meet regularly to discuss their experiences, share tips, and offer mutual support.

Q8: Post-1984 letter rulings may be substantial authority

Q27: Which Regulations have the force and effect

Q29: The taxpayer should use ASC 740-30 (APB

Q40: A draftsman is an example of:<br>A) a

Q42: A privately held company securing a loan

Q58: Qute, Inc., earns book net income before

Q66: Which organisational form best enables the owners

Q67: Tomas owns a sole proprietorship, and Lucy

Q126: Hans purchased a new passenger automobile on

Q187: Alice purchased office furniture on September 20,