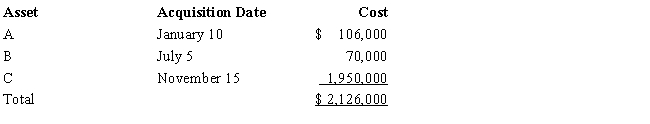

Audra acquires the following new five-year class property in 2016:

Audra elects § 179 treatment for Asset C. Audra's taxable income from her business would not create a limitation for purposes of the § 179 deduction. Audra claims the full available additional first-year depreciation deduction. Determine her total cost recovery deduction (including the § 179 deduction) for the year.

Definitions:

Partnership Terminated

The ending or dissolution of a business partnership through various means, including mutual agreement, expiration of terms, or court order.

Limited Partnership

A partnership arrangement where at least one partner has limited liability to the extent of their investment in the business, while at least one other has unlimited liability.

General Partner

A partner in a partnership who has unlimited liability for the debts of the partnership and takes part in the management of the business.

Management

The process of planning, organizing, leading, and controlling resources to achieve organizational goals efficiently and effectively.

Q7: The amount received for a utility easement

Q35: Which of the following is not a

Q50: Martha is unmarried with one dependent and

Q67: Section 1231 applies to the sale or

Q83: Jared, a fiscal year taxpayer with a

Q105: Andrew, who operates a laundry business, incurred

Q116: For a new car that is used

Q123: Under what circumstance is there recognition of

Q153: Since wash sales do not apply to

Q165: Last year, Green Corporation incurred the following