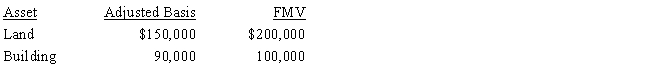

On September 18, 2016, Jerry received land and a building from Ted as a gift. Ted had purchased the land and building on March 5, 2013, and his adjusted basis and the fair market value at the date of the gift were as follows:

Ted paid no gift tax on the transfer to Jerry.

a.Determine Jerry's adjusted basis and holding period for the land and building.

b.Assume instead that the FMV of the land was $89,000 and the FMV of the building was $60,000. Determine Jerry's adjusted basis and holding period for the land and building.

Definitions:

Corporate Tax Rate

The percentage of a corporation's profits that it must pay as tax to the government.

Straight Line Basis

A method of calculating depreciation or amortization by evenly spreading the cost of an asset over its useful life.

Market Value

The current price at which an asset or service can be bought or sold in the open market.

Working Capital

The difference between a company's current assets and its current liabilities, representing the short-term liquidity and operational efficiency of the company.

Q6: In 2016 Angela, a single taxpayer with

Q9: In 2015, Kipp invested $65,000 for a

Q11: Zeke made the following donations to qualified

Q15: On June 1, 2016, Norm leases a

Q18: A niece who lives with taxpayer, is

Q37: Describe the types of activities and taxpayers

Q42: Once they reach age 65, many taxpayers

Q55: Wes's at-risk amount in a passive activity

Q70: Pat purchased a used five-year class asset

Q119: A taxpayer's earned income credit is dependent