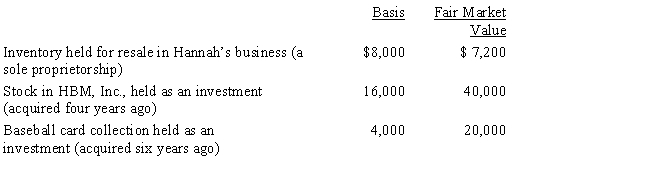

Hannah makes the following charitable donations in the current year:

The HBM stock and the inventory were given to Hannah's church, and the baseball card collection was given to the United Way. Both donees promptly sold the property for the stated fair market value. Disregarding percentage limitations, Hannah's current charitable contribution deduction is:

Definitions:

Net Financial Assets

The difference between a person's or entity's total financial assets and total financial liabilities.

Security

Financial instruments or assets held to back debts or investments, or as a means to ensure the fulfillment of financial obligations.

Insurance Contract

A legally binding agreement between an insurer and the insured, detailing the terms for the payment of claims under certain conditions.

Securities Act

A law or legislation that regulates the issuance and sale of securities to protect investors against misrepresentation, deceit, and other frauds.

Q26: Jack received a court award in a

Q32: Hannah makes the following charitable donations in

Q38: The tax treatment of corporate distributions at

Q64: List at least three exceptions to the

Q64: If a capital asset is sold at

Q73: Currently, the top income tax rate in

Q101: If a stock dividend is taxable, the

Q146: Louise works in a foreign branch of

Q147: Evaluate the following statements:<br>I.<br>De minimis fringe benefits

Q200: Kate exchanges land held as an investment