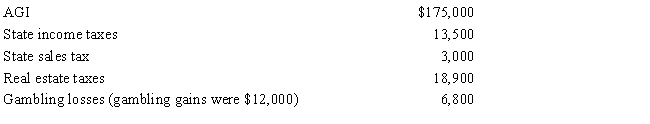

Paul, a calendar year married taxpayer, files a joint return for 2016. Information for 2016 includes the following:

Paul's allowable itemized deductions for 2016 are:

Definitions:

Income Sharing

Income sharing refers to the distribution of profits or earnings among partners, stakeholders, or employees in a company or cooperative.

Cocaine

A powerful and addictive stimulant drug derived from the leaves of the coca plant.

Partnership Agreement

A legal document that outlines the rights, responsibilities, and distribution of profits and losses among partners in a business partnership.

Religious Beliefs

Personal or institutionalized system of attitudes, morals, ethics, worldviews, and practices centered on the idea of a supernatural power or powers.

Q1: After paying down the mortgage on their

Q12: In the current year, Jerry pays $8,000

Q17: Beth forms Lark Corporation with a transfer

Q48: Azul Corporation, a calendar year C corporation,

Q78: Robin Corporation, a calendar year C corporation,

Q84: Section 1231 property generally does not include

Q89: After graduating from college, Clint obtained employment

Q108: Verway, Inc., has a 2016 net §

Q109: Gambling losses may be deducted to the

Q153: An ex-husband (divorce occurred last year) who