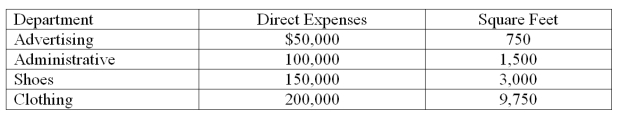

Naples operates a retail store and has two service departments and two operating departments, Shoes and Clothing. During the current year, the departments had the following direct expenses and occupied the flowing amount of floor space.

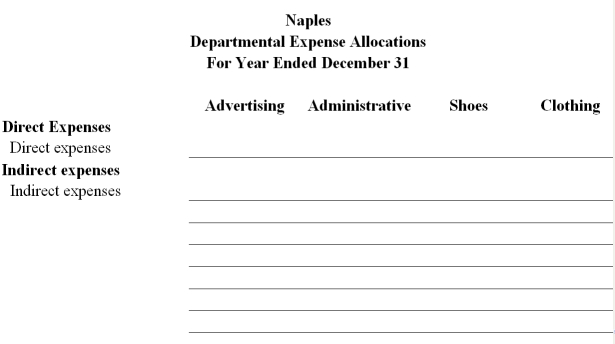

The advertising department developed and aired 150 spots. Of these spots, 60 spots were for Shoes and 90 spots were for Clothing. The store sold $1,500,000 of merchandise during the year; $675,000 in Shoes and $825,000 in Clothing. Indirect expenses include rent, utilities, and insurance expense. Total indirect expenses of $220,000 are allocated to all departments. Prepare a departmental expense allocation spreadsheet for Naples. The spreadsheet should assign (1) direct expenses to each of the four departments, (2) allocate the indirect expenses to each department on the basis of floor space occupied, (3) the advertising department's expenses to the two operating departments on the basis of ad spots placed promoting each department's products, (4) the administrative department's expenses based on the amount of sales. Complete the departmental expense allocation spreadsheet below. Provide supporting computations for the expense allocations below the spreadsheet.

Definitions:

Rising Housing Costs

An increase in the price of purchasing or renting homes, often making housing unaffordable for many individuals and families.

Racial Inequality

The unequal treatment or disparities experienced by individuals or groups based on race, affecting opportunities, rights, and well-being.

Residential Segregation

Residential segregation refers to the physical separation of two or more groups into different neighborhoods, often based on race, ethnicity, or income.

Consequences

The outcomes or effects that result from a particular action or set of conditions.

Q6: If the predetermined overhead allocation rate is

Q20: Rudy Co. has total fixed costs of

Q55: A company has an overhead application rate

Q89: Farber, Inc., has four departments. The Administrative

Q117: Larabee Company produces two types of product,

Q129: During its most recent fiscal year, Simon

Q131: Match the following terms with the definitions.<br>

Q141: Stritch Company is trying to decide how

Q154: A company uses the weighted average method

Q154: Kelley Company and Mason Company each have