Based on the unadjusted trial balance for Bella's Beauty Salon and the adjusting information given below, prepare the adjusting journal entries for Bella's Beauty Salon.

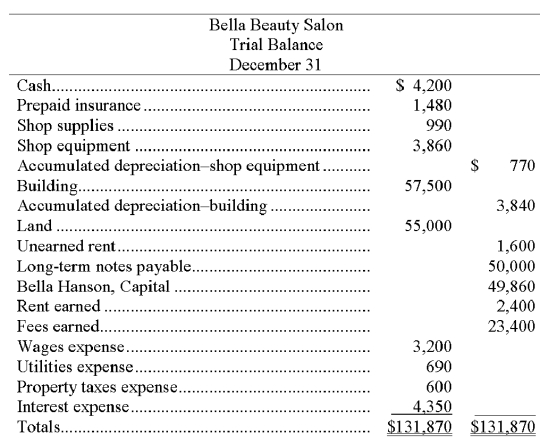

Bella Beauty Salon's unadjusted trial balance for the current year follows:

Additional information:

a. An insurance policy examination showed $1,240 of expired insurance

b. An inventory count showed $210 of unused shop supplies still available.

c. Depreciation expense on shop equipment, $350.

d. Depreciation expense on the building, $2,220.

e. A beautician is behind on space rental payments, and this $200 of accrued revenues was unrecorded at the time the trial balance was prepared.

f. $800 of the Unearned Rent account balance was earned by year-end.

g. The one employee, a receptionist, works a five-day workweek at $50 per day. The employee was paid last week but has worked four days this week for which she has not been paid.

h. Three months' property taxes, totaling $450, have accrued. This additional amount of property taxes expense has not been recorded

i. One month's interest on the note payable, $600, has accrued but is unrecorded.

Definitions:

Sum Of Squares

A statistical measure that quantifies the dispersion of a set of data points by summing the squared deviations from their mean.

Simple Regression

Simple regression is a statistical method used to examine the relationship between one independent variable and one dependent variable by fitting a linear equation to observed data.

Slope

The measure of the steepness or incline of a line, indicating the rate of change between two variables.

Q6: Which of the following resistance to change

Q21: After posting the entries to close all

Q32: The purchase of supplies on credit should

Q51: Based on the unadjusted trial balance for

Q83: A debit entry is always favorable.

Q85: A liability created by the receipt of

Q99: The following information is available for Crandall

Q100: Josephine's Bakery had the following assets and

Q121: A trial balance prepared after adjustments have

Q155: Objectivity means that financial information is supported