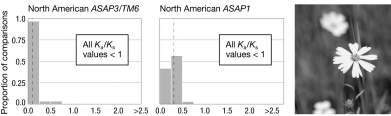

The figure shows the Ka /Ks values for two regulatory genes in pairs of species in (A) North American tarweeds and (B) Hawaiian silverswords. The dashed lines are the mean Ka/Ks values. What do these data indicate about how these genes are evolving differently in these two groups of taxa? A

B

Definitions:

Confederation

The process that united the British colonies in North America as the Dominion of Canada in 1867.

Federal Jurisdiction

The legal authority of federal or national government bodies to legislate and adjudicate matters, as distinguished from state or local jurisdictions.

Personal Freedoms

The rights and liberties that allow individuals to express themselves, live without government interference, and make personal choices.

Charter

A legal document or authorization establishing a corporation or municipality and defining its rights and privileges.

Q1: In which model of allopatric speciation is

Q5: Bull elephant seals are approximately:<br>A) 3 times

Q6: If you are interested in preserving phylogenetic

Q9: Soldier (and worker) castes are sterile and

Q10: Mendel uncovered 3 main findings<br>A) Genes are

Q11: What does it mean for two alleles

Q23: What is LUCA and why is it

Q29: The figure shows (A) a cladogram of

Q40: What are the two major types of

Q49: In order to survive in the geothermally