The City of Warwick received $4,000,000 from one of its most prominent citizens during the year ended June 30, 20X9. The donor stipulated that the $4,000,000 be invested permanently, and that interest and dividends earned on the investments be used to support the homeless people of Warwick. During the year ended June 30, 20X9, dividends received from stock investments amounted to $20,000, while interest received from bond investments amounted to $40,000. At June 30, 20X9, $10,000 of interest was earned, but it will not be received until July of 20X9. The fair value of the securities in which the $4,000,000 was invested had increased $8,000 by June 30, 20X9.

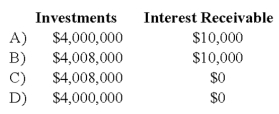

-Refer to the above information. On the statement of fiduciary net assets at June 30, 20X9, the nonexpendable trust fund should report investments and interest receivable of:

Definitions:

Ratification

The process of officially sanctioning a treaty or agreement to make it legally binding.

Adoption

The legal process by which an individual assumes the parenting of another, usually a child, from that person's biological or legal parent(s).

Unauthorized Contracts

Unauthorized contracts refer to agreements made by individuals who lack the legal authority or capacity to bind themselves or another party to contractual obligations.

Apparent Authority

A situation where a reasonable person would understand that an agent had authority to act, even if the agent did not have actual authority.

Q19: Ballard University, a private not-for-profit, billed four

Q33: According to NACUBO guidelines, what is the

Q43: The activities of private not-for-profits are commonly

Q64: The City of Fargo issued general obligation

Q71: Contrast revenue recognition under the accrual and

Q78: FASB standards require conditional promises to give

Q92: With respect to public colleges and universities,

Q112: A city government sells police cars no

Q116: According to FASB standards, how are not-for-profit

Q130: Contributions to a private not-for-profit are recorded