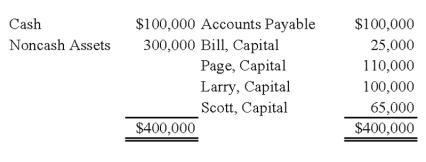

Bill, Page, Larry, and Scott have decided to terminate their partnership. The partnership's balance sheet at the time they decide to wind up is as follows:  During the winding up of the partnership, the other assets are sold for $150,000 and the accounts payable are paid. Page and Larry are personally solvent, but Bill and Scott are personally insolvent. The partners share profits and losses in the ratio of 4:2:1:3.

During the winding up of the partnership, the other assets are sold for $150,000 and the accounts payable are paid. Page and Larry are personally solvent, but Bill and Scott are personally insolvent. The partners share profits and losses in the ratio of 4:2:1:3.

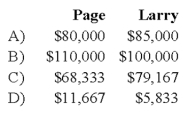

-Based on the preceding information, what amount will be distributed to Page and Larry upon liquidation of the partnership?

Definitions:

General Tests

General Tests refer to a set of standard procedures or criteria used for evaluating or assessing a specific aspect or condition.

Relationship Test

The Relationship Test is an IRS criterion used to determine if a person qualifies as a dependent based on their relationship to the taxpayer.

Head of Household

A tax filing status for unmarried individuals that provides a higher standard deduction and lower tax rates than the Single filing status, if they have a qualifying person living with them.

Standard Deduction

A fixed dollar amount deducted from an individual's taxable income, reducing the amount of income subject to federal income tax, which varies by filing status and is adjusted annually.

Q27: Which of the following pledges of support

Q42: Based on the preceding information, the entries

Q43: Based on the preceding information, at what

Q51: Refer to the above information. Assuming the

Q59: On January 1, 2008, Pace Company

Q60: Based on the preceding information, at what

Q61: FASB Statement 136 Transfer of Assets to

Q105: Long-term debt to be paid from proprietary

Q122: The Statement of Cash Flows for a

Q160: Identify the standard setting body for private