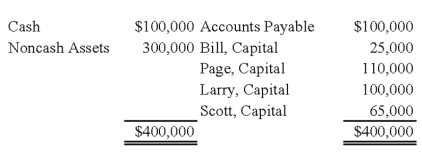

Bill, Page, Larry, and Scott have decided to terminate their partnership. The partnership's balance sheet at the time they decide to wind up is as follows:  During the winding up of the partnership, the other assets are sold for $150,000 and the accounts payable are paid. Page and Larry are personally solvent, but Bill and Scott are personally insolvent. The partners share profits and losses in the ratio of 3:2:1:4.

During the winding up of the partnership, the other assets are sold for $150,000 and the accounts payable are paid. Page and Larry are personally solvent, but Bill and Scott are personally insolvent. The partners share profits and losses in the ratio of 3:2:1:4.

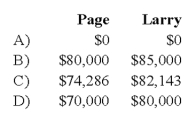

-Based on the preceding information, what amounts will be distributed to Page and Larry upon liquidation of the partnership?

Definitions:

Partial ANOVA Table

A component of the ANOVA (Analysis of Variance) output that summarizes partial calculations and results, often excluding some variables or interactions.

Degrees of Freedom

The quantity of separate variables or numbers that are allowed to fluctuate during the evaluation without breaching any restrictions.

F-test

is a statistical test used to compare the variances of two populations to determine if they are equal or not.

F-test Statistic

A value used to determine if there are significant differences between the variances of two or more datasets.

Q5: A debt service fund for the City

Q10: Under the modified accrual basis of accounting,

Q13: Refer to the above information. What is

Q23: Contrast the economic resources measurement focus and

Q24: Based on the information given above, what

Q100: Which of the following statements are not

Q105: Long-term debt to be paid from proprietary

Q115: A not-for-profit organization receiving donated fixed assets

Q125: What are Enterprise funds used for?<br>A) To

Q146: Which of the following does not use