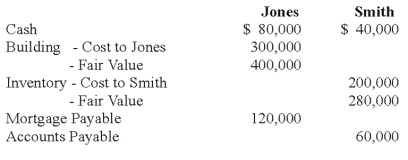

Jones and Smith formed a partnership with each partner contributing the following items:  Assume that for tax purposes Jones and Smith agree to share equally in the liabilities assumed by the Jones and Smith partnership.

Assume that for tax purposes Jones and Smith agree to share equally in the liabilities assumed by the Jones and Smith partnership.

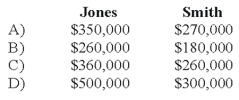

-Refer to the above information. What is the balance in each partner's capital account for financial accounting purposes?

Definitions:

Copyleft

A licensing concept in which an author makes a work freely available for others to copy, distribute, and modify, requiring all modified versions to be free as well.

Open Source Software

is software with source code that anyone can inspect, modify, and enhance.

Copyright Law

A legal framework designed to protect the original works of authors, composers, and creators by providing them with exclusive rights to use and distribute their creations.

Online Word Processing Applications

Web-based programs that allow users to create, edit, and share documents in a browser without installing software.

Q23: Which of the following is a consequence

Q26: Based on the information provided, what amount

Q27: Consolidated financial statements tend to be most

Q28: Two sole proprietors, L and M, agreed

Q45: Refer to the information provided above. Using

Q46: The government-wide financial statements prepared for a

Q58: Which of the following is NOT a

Q81: With respect to the Statement of Cash

Q107: Depreciation on capital assets is included as

Q135: Under FASB Statement 116, reclassifications of net