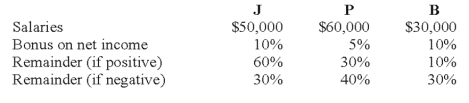

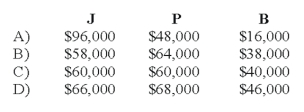

The JPB partnership reported net income of $160,000 for the year ended December 31, 2008. According to the partnership agreement, partnership profits and losses are to be distributed as follows:  How should partnership net income for 2008 be allocated to J, P, and B?

How should partnership net income for 2008 be allocated to J, P, and B?

Definitions:

Stock Investments

The purchase of shares in a company with the expectation of generating income or capital gains.

Insignificant Influence

Refers to a situation in which an investor does not have enough stake or power in an investee company to affect its decisions or policies.

Equity Method Investments

An accounting technique used to record investments in which the investor holds significant influence over the investee, usually recognized when owning 20-50% of the voting stock.

Cash Dividends

Earnings distributed to shareholders in the form of cash, reflecting a company's profitability and its decision to return a portion of profits back to investors.

Q17: In 2017, Susan tells The Art Museum,

Q21: Based on the preceding information, what will

Q33: Under the cost method of accounting for

Q37: The government-wide statements and the fund statements

Q37: Refer to the information provided above. Using

Q41: Company X acquires 100 percent of the

Q43: Peanut Company acquired 75 percent of Snoopy

Q59: Which of the following items is not

Q62: Which of the following are the governmental

Q95: Below are the complete set of published