In the AD partnership, Allen's capital is $140,000 and Daniel's is $40,000 and they share income in a 3:1 ratio, respectively. They decide to admit David to the partnership. Each of the following questions is independent of the others.

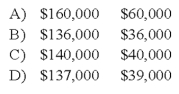

-Refer to the information provided above. David invests $40,000 for a one-fifth interest in the total capital of $220,000. What are the capital balances of Allen and Daniel after David is admitted into the partnership?

Definitions:

Net Loss

The result when a company's total expenses exceed its total revenues during a specific period, indicating a negative profit.

Break-Even Point

The point at which total costs and total revenues are exactly equal, resulting in no net profit or loss for a business.

Net Operating Income

The income from a company's primary business operations, excluding deductions of interest and taxes.

Fixed Expenses

Costs that do not change with the level of production or sales over a short period of time, such as rent or salaries.

Q19: Pink Inc. sells half of its 70%

Q25: Based on the preceding information, immediately after

Q42: A citizen of York purchased a truck

Q49: Which of the following is not a

Q49: When the local currency of the foreign

Q50: Based on the information given above, what

Q59: For which of the following funds are

Q68: Based on the preceding information, which of

Q82: The Statement of Functional Expenses:<br>A) Is required

Q98: Which of the following statements regarding fund