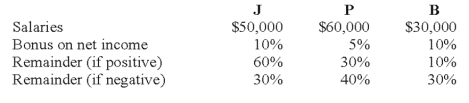

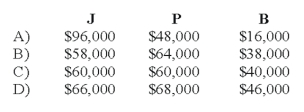

The JPB partnership reported net income of $160,000 for the year ended December 31, 2008. According to the partnership agreement, partnership profits and losses are to be distributed as follows:  How should partnership net income for 2008 be allocated to J, P, and B?

How should partnership net income for 2008 be allocated to J, P, and B?

Definitions:

Commingled Fungible Goods

Items that are interchangeable with others of the same type, which have been mixed or blended, making individual properties indistinguishable.

Contributing Parties

Entities or individuals that contribute resources, information, or efforts towards a common project, goal, or agreement.

Fungible Goods

Items or goods that are interchangeable with others of the same type, quality, and quantity.

Gross Negligence

A lack of care that demonstrates a reckless disregard for the safety or lives of others, significantly beyond ordinary negligence.

Q5: Based on the preceding information, what amount

Q6: All of the following are elements of

Q8: Which of the following observations concerning interfund

Q8: FASB 141R (ASC 805) requires contingent consideration

Q31: Based on the preceding information, what will

Q32: The personal financial statements of a partner

Q40: On December 1, 2008, Merry Corporation acquired

Q60: Based on the preceding information, at what

Q61: What account should be debited in the

Q101: Which of the following statements is false