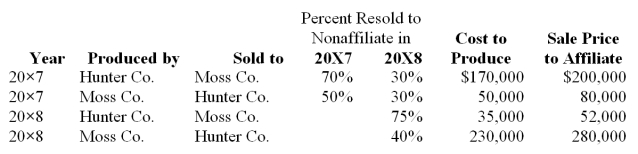

Hunter Company and Moss Company both produce and purchase fabric for resale each period and frequently sell to each other. Since Hunter Company holds 80 percent ownership of Moss Company, Hunter's controller compiled the following information with regard to intercompany transactions between the two companies in 20X7 and 20X8:  Required:

Required:

a. Give the eliminating entries required at December 31, 20X8, to eliminate the effects of the inventory transfers in preparing a full set of consolidated financial statements.

b. Compute the amount of cost of goods sold to be reported in the consolidated income statement for 20X8.

Definitions:

Income from Continuing Operations

This refers to the earnings generated from the normal business activities excluding one-time transactions, discontinued operations, and other irregular items.

Loss on Discontinuance

A financial loss that occurs as a result of the cessation of a business unit or operation.

Asset Turnover Ratio

A financial metric that measures the efficiency of a company in using its assets to generate sales.

Profit Margin

A financial metric that measures the percentage of revenue that exceeds the cost of goods sold, indicating the profitability of a company.

Q3: Based on the preceding information, what is

Q6: All of the following are elements of

Q20: Based on the figure shown here, which

Q23: Refer to the above information. On the

Q30: Which sense requires the stimulation of chemoreceptors?<br>A)

Q33: Which of the following communities is the

Q33: Based on the preceding information, at what

Q39: A limited liability company (LLC):<br>I. is governed

Q46: Jacob is studying a population of wrens

Q52: The general fund of Caldwell had the