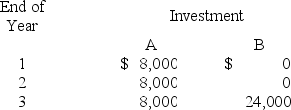

Alfarsi Industries uses the net present value method to make investment decisions and requires a 15% annual return on all investments. The company is considering two different investments. Each require an initial investment of $15,000 and will produce cash flows as follows:  The present value factors of $1 each year at 15% are:

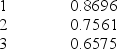

The present value factors of $1 each year at 15% are: The present value of an annuity of $1 for 3 years at 15% is 2.2832

The present value of an annuity of $1 for 3 years at 15% is 2.2832

The net present value of Investment B is:

Definitions:

Inner Space

A psychological or spiritual concept referring to the exploration of one's own mind or inner self.

Amygdala

A section of the brain that is responsible for detecting fear and preparing for emergency events.

Tasks

Specific pieces of work or activities that are to be accomplished within a given timeframe.

EEG

Electroencephalography, a method used to record electrical activity of the brain through electrodes placed on the scalp.

Q38: Spilker Linens Store has three departments: Bath,

Q48: In a decentralized organization, decisions are made

Q57: Based on a predicted level of production

Q64: Soar Incorporated is considering eliminating its mountain

Q105: A company reported that its bonds with

Q118: The accountant for TI Company is preparing

Q144: Markson Company had the following results of

Q150: A brief focus on important analysis results

Q175: A cost center is a unit of

Q196: Direct expenses require allocation across departments because