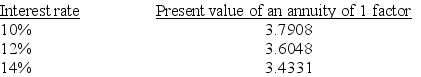

A company is considering a 5-year project. It plans to invest $62,000 now and it forecasts cash flows for each year of $16,200. The company requires a hurdle rate of 12%. Calculate the internal rate of return to determine whether it should accept this project. Selected factors for a present value of an annuity of 1 for five years are shown below:

Definitions:

Lewis Tappan

A prominent 19th-century abolitionist and a founder of the American Anti-Slavery Society who also played a key role in the Amistad case.

Colonization Society

A group or organization established in the early 19th century advocating for the migration of free African Americans to Africa; the American Colonization Society is a prime example.

William Lloyd Garrison

An American abolitionist who was prominent in the anti-slavery movement and is well known for founding and editing the abolitionist newspaper "The Liberator."

Q24: The following is a partially completed departmental

Q26: An expense that is readily traced to

Q37: The direct method separately lists operating cash

Q56: The following selected account balances are taken

Q65: A company is planning to purchase a

Q99: Epsilon Co. can produce a unit of

Q102: The following summaries from the income statements

Q117: A company uses the following standard costs

Q127: The cash conversion cycle is calculated by

Q160: Refer to the following selected financial