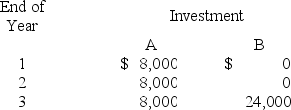

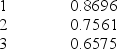

Alfarsi Industries uses the net present value method to make investment decisions and requires a 15% annual return on all investments. The company is considering two different investments. Each require an initial investment of $15,000 and will produce cash flows as follows:  The present value factors of $1 each year at 15% are:

The present value factors of $1 each year at 15% are: The present value of an annuity of $1 for 3 years at 15% is 2.2832

The present value of an annuity of $1 for 3 years at 15% is 2.2832

The net present value of Investment B is:

Definitions:

Government Bonds

Debt securities issued by a government to support government spending, which investors can purchase, typically considered low-risk investments.

Accrued Interest

The accumulated interest on a note payable or receivable that has been earned but not yet received or paid out.

Semiannual Interest

Interest that is calculated and paid twice a year, often on bonds or loans.

Subsidiary Company

A company that is completely or partly owned and wholly controlled by another company, known as the parent company.

Q29: A(n) _ is the potential benefit lost

Q49: The time value of money concept:<br>A) Means

Q50: Regardless of the system used in departmental

Q77: Pleasant Hills Properties is developing a golf

Q139: Refer to the following selected financial

Q156: Martinez Corporation reported net sales of $765,000,

Q164: Noncash investing and financing activities may be

Q169: Division A produces a part with the

Q175: The following company information is available for

Q221: Powers Company reported net sales of $1,200,000,