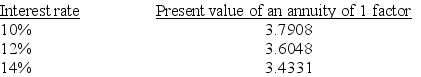

A company is considering a 5-year project. It plans to invest $62,000 now and it forecasts cash flows for each year of $16,200. The company requires a hurdle rate of 12%. Calculate the internal rate of return to determine whether it should accept this project. Selected factors for a present value of an annuity of 1 for five years are shown below:

Definitions:

Implicit Memories

Memories that are not consciously recalled but influence behaviors and knowledge, such as skills and tasks.

Hippocampus

A region of the brain associated with learning and memory, particularly transferring short-term memory to long-term memory.

Anterograde Amnesia

The inability to form new memories following a traumatic event, though memory for events before the event is usually intact.

Retrograde Amnesia

A loss of memory-access to events that occurred, or information that was learned, before an incident that caused the amnesia.

Q22: Sammy Company is considering eliminating its commercial

Q71: If the internal rate of return (IRR)

Q75: Use the following information about the calendar-year

Q79: When computing a price variance, the price

Q80: A granary allocates the cost of

Q80: Use the following data to find the

Q102: For each of the following separate cases,

Q123: The Linens Department of the Krafton Department

Q163: Milltown Company specializes in selling used cars.

Q173: A company's income statement showed the following: