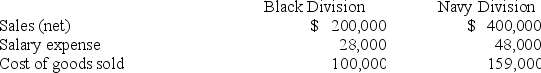

Marian Corporation has two separate divisions that operate as profit centers. The following information is available for the most recent year:  The Black Division occupies 20,000 square feet in the plant. The Navy Division occupies 30,000 square feet. Rent is an indirect expense and is allocated based on square footage. Rent expense for the year was $50,000. Compute gross profit for the Black and Navy Divisions, respectively.

The Black Division occupies 20,000 square feet in the plant. The Navy Division occupies 30,000 square feet. Rent is an indirect expense and is allocated based on square footage. Rent expense for the year was $50,000. Compute gross profit for the Black and Navy Divisions, respectively.

Definitions:

Capital

Financial resources or assets owned by an individual or business that are useful in furthering development or generating income.

Operating Costs

Expenses directly related to the day-to-day functioning of a business, excluding costs associated with financing or investments.

Preferred Dividends

Payments made to preferred shareholders before common shareholders receive any dividends.

After-Tax Income

The net income an individual or corporation receives after all income taxes have been deducted from gross income.

Q61: Alfarsi Industries uses the net present value

Q70: Tate Company's current year income statement and

Q82: Yelk Garage uses time and materials pricing.

Q92: Cahuilla Corporation predicts the following sales in

Q93: The sales budget for Modesto Corp. shows

Q123: An unfavorable variance is recorded with a

Q139: The financial statement effects of the budgeting

Q146: Projects with a profitability index of greater

Q196: Alfredo Inc. reports net income of $230,000

Q201: A main purpose of the statement of