Capital budgeting computations

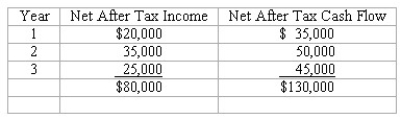

A project costing $80,000 has an estimated life of 3 years and no salvage value.The estimated net income and net after tax cash flows from the project are as follows:  The company's minimum desired rate of return for discounted cash flow analysis is 10%.The present value of $1 at compound interest of 10% at 1,2,and 3 years is 0.909,0.826,and 0.751,respectively.The present value of a $1 annuity for three years at 10% is 2.487.The company uses straight-line depreciation.

The company's minimum desired rate of return for discounted cash flow analysis is 10%.The present value of $1 at compound interest of 10% at 1,2,and 3 years is 0.909,0.826,and 0.751,respectively.The present value of a $1 annuity for three years at 10% is 2.487.The company uses straight-line depreciation.

Compute

(a)Net present value of the project.________

(b)The rate of return on average investment ________(rounded)

Calculations

Definitions:

Using Money

Likely referring to the utilization of financial resources or capital for transactions, investments, or other financial activities.

Term

A fixed or limited period for which something, such as an agreement or investment, lasts or is intended to last.

Due Date

The date by which an obligation, such as a payment or submission, is required to be fulfilled.

Note Issued

A written promise to pay a specified amount of money, often with interest, at a future date.

Q2: All of the following are roadblocks between

Q4: Which of the following regional trade agreements

Q20: Which of the following are required elements

Q35: The measurement of the impact of change

Q42: Which of the following is not considered

Q50: Transfer prices and cash flow<br>Satellite Products,Inc.owns two

Q50: While high speed trains in the United

Q58: A sunk cost is an expenditure that

Q62: The higher the required rate of return

Q66: Define the measurement model known as the