Accounting Terminology Listed Below Are Nine Technical Accounting Terms Introduced or Emphasized

Accounting terminology

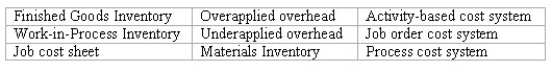

Listed below are nine technical accounting terms introduced or emphasized in this chapter:  Each of the following statements may (or may not)describe one of these technical terms.In the space provided below each statement,indicate the accounting term described,or answer "None" if the statement does not correctly describe any of the terms.

Each of the following statements may (or may not)describe one of these technical terms.In the space provided below each statement,indicate the accounting term described,or answer "None" if the statement does not correctly describe any of the terms.

________ (a)The balance remaining in the Manufacturing Overhead account when the overhead application rate used during the period is too low.

________ (b)The account credited as component parts are transferred into production.

________ (c)A schedule used to accumulate manufacturing costs and to determine the unit costs associated with a specific customer's order.

________ (d)The inventory account credited when the cost of goods sold is recorded.

________ (e)The type of cost accounting system most likely used by an oil refinery engaged in the continuous production of petroleum products.

________ (f)The inventory account debited when manufacturing cost accounts (such as Direct Labor or Materials Inventory)are credited.

________ (g)The type of cost accounting system likely to be used by a machine shop that manufactures items to the specifications provided by its customers.

Definitions:

Oil Change

A maintenance service for vehicles that involves replacing the old motor oil and oil filter with new ones to ensure the engine runs smoothly.

Delivery Truck

A vehicle used for transporting goods and products from one location to another.

Expenditures

The outflow of funds paid or to be paid for an organization's operations and investments, including costs, expenses, and asset acquisitions.

Parking Area Paving

The process of applying asphalt, concrete, or other paving materials to create a designated parking space.

Q8: When direct materials are applied to the

Q10: Accounting practices are affected by all of

Q56: The process of using activity-based costing to

Q57: Comprehensive income may be presented in a

Q63: An activity-based costing system would probably not

Q68: When using the indirect method,depreciation expense:<br>A)Increases net

Q70: At the reduced selling price of $65

Q76: A corporation that uses a strategy of

Q79: What are the total relevant costs of

Q83: Langdon Company manufactures custom designed toy sailboats.The