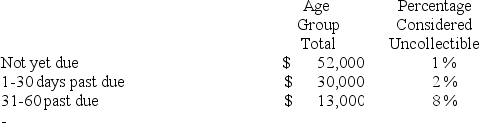

Oceanside Company uses the balance sheet approach in estimating uncollectible accounts expense.Its Allowance for Doubtful Accounts has a $1,200 credit balance prior to adjusting entries.It has just completed an aging analysis of accounts receivable at December 31,2018.This analysis disclosed the following information:  What is the appropriate balance for Oceanside's Allowance for Doubtful Accounts at December 31,2018?

What is the appropriate balance for Oceanside's Allowance for Doubtful Accounts at December 31,2018?

Definitions:

Securities Act Of 1933

A U.S. law enacted to ensure transparency and fairness in the securities market, requiring issuers of securities to disclose significant information to investors.

Definition Of Security

A financial instrument that represents an ownership position in a publicly-traded corporation (stock), a creditor relationship with a governmental body or a corporation (bond), or rights to ownership as represented by an option.

Resold Without Registration

Referring to the sale of securities without registering them with the required regulatory body, often not in compliance with securities law.

Most Securities

Financial instruments that signify ownership (stocks), a debt agreement (bonds), or rights to ownership (derivatives) that investors can buy and sell.

Q6: Assuming Neptune does not sell this investment,the

Q10: How much is owed the employees for

Q39: Which of the following is not a

Q40: Inventory is a relatively liquid asset and

Q46: The concept of materiality:<br>A)Treats as material only

Q56: Evaluating the quality of receivables<br>(a. )The 2018

Q76: Adjusting Entries<br>Identify four types of timing differences

Q98: The sequence of accounting procedures used to

Q109: The inventory turnover rate is equal to

Q150: Every transaction that affects an income statement