Journalize and post basic transactions

Precision Grading Co.was organized to grade construction sites.

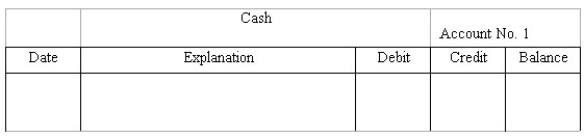

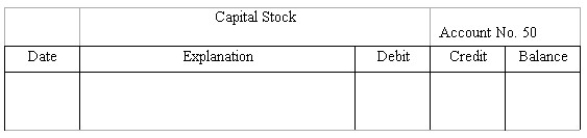

* On June 1,owner Dave Precision deposited $90,000 in a new bank account opened in the name of the business in exchange for stock.

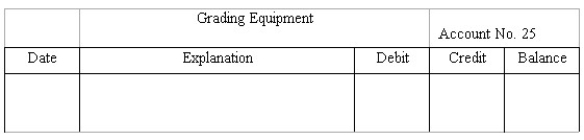

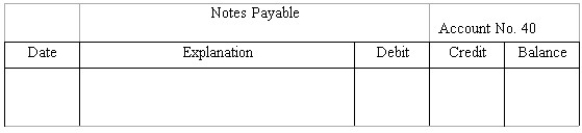

* On June 3,the company acquired grading equipment costing $89,000,paying $43,000 cash and signing a note payable for the balance.

* On June 10,the company paid $13,000 of the amount owed for equipment acquired on June 3.

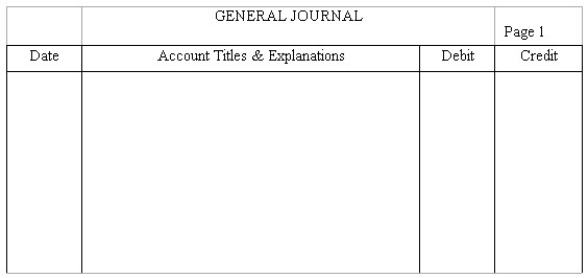

Instructions: Journalize these three transactions and post to the ledger accounts.

Definitions:

National Association For Medical Assistants

A professional organization that represents the interests of medical assistants and promotes their professional skills and ethics in the healthcare industry.

Orthopedic Medical Assistant

A healthcare professional who supports orthopedic physicians in treating musculoskeletal system conditions.

Musculoskeletal System

The organ system that enables humans to move using the muscular and skeletal systems, including bones, muscles, cartilage, tendons, ligaments, and joints.

Body Mechanics

The application of physical principles to achieve maximum efficiency and to limit risk of physical stress or injury to the practitioner of physical therapy, massage therapy, or chiropractic or osteopathic manipulation.

Q4: An annuity due assumes the cash flow

Q10: Effects of transactions on balance sheet items<br>Show

Q15: The future value of an annuity is:<br>A)Always

Q17: Recording transactions in T accounts;trial balance<br>On May

Q26: Judy Bright has just won the lottery.She

Q45: Return on equity is a commonly used

Q101: At the beginning of 2018,England Dresses has

Q101: In a trial balance prepared on January

Q108: Which of the following liabilities would most

Q117: 200 What is the amount of working