Accounting terminology

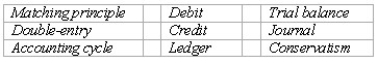

Listed below are nine technical accounting terms introduced in this chapter:  For each question part A through G,choose a term from the table above that best matches.

For each question part A through G,choose a term from the table above that best matches.

(A. )The accounting record in which transactions are initially recorded.

(B. )A concept designed to avoid overstatement of the financial strength of a company.

(C. )A schedule prepared to determine the equality of the debit and credit amounts in the ledger.

(D. )An amount entered in the right side of a ledger account.

(E. )The sequence of procedures involved in recording transactions,processing the information in the accounting system,and summarizing the information in the form of financial statements.

(F. )The accounting record that contains a separate account for each type of asset and liability,and for each element of owners' equity appearing in the balance sheet.

(G. )The system of accounting in which every business transaction is recorded by equal dollar amounts of debit and credit entries.

Definitions:

Tangible Costs

Costs associated with an identifiable physical item or service, such as raw materials, labor, and manufacturing expenses.

Climatic Conditions

The weather conditions prevailing in an area in general or over a long period, affecting living conditions, agriculture, and industry.

Location Decision

The process of selecting an optimal site for a new facility, taking into account factors like cost, logistics, and market access.

Clustering

The location of competing companies near each other, often because of a critical mass of information, talent, venture capital, or natural resources.

Q10: Objectives of financial reporting to external investors

Q17: Recording transactions in T accounts;trial balance<br>On May

Q26: Accumulated Depreciation is:<br>A)An asset account.<br>B)A revenue account.<br>C)A

Q26: Which of the following accounts normally has

Q30: Discounting a future amount of a cash

Q60: 200 Supreme's gross profit rate was:<br>A)42.9%.<br>B)57.7%.<br>C)20.0%.<br>D)31.7%.

Q75: How would a company's working capital be

Q105: A journal entry to record revenue could

Q111: If a company records a purchase at

Q136: The collection of an account receivable is