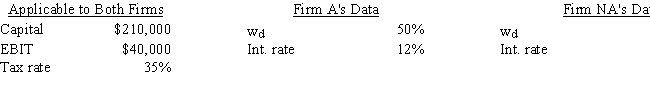

Firm A is very aggressive in its use of debt to leverage up its earnings for common stockholders,whereas Firm NA is not aggressive and uses no debt.The two firms' operations are identical--they have the same total investor-supplied capital,sales,operating costs,and EBIT.Thus,they differ only in their use of financial leverage (wd) .Based on the following data,how much higher or lower is A's ROE than that of NA,i.e. ,what is ROEA - ROENA? Do not round your intermediate calculations.

Definitions:

Oppose Your Recommendation

Challenging or arguing against a suggested course of action or advice given.

Summary Reports

Concise documents that outline the main points of a longer report or discussion.

Academic Settings

Environments related to educational institutions like schools or universities, where learning, teaching, and research activities occur.

Business Settings

The environments or contexts within which commercial operations or professional interactions occur.

Q3: At the beginning of the year,you purchased

Q3: Maxwell Feed & Seed is considering a

Q3: Mohammad is paid a weekly commission of

Q6: To help finance a major expansion,Castro Chemical

Q10: If investors are risk averse and hold

Q11: Fairchild Garden Supply expects $700 million of

Q20: Halka Company is a no-growth firm.Its sales

Q30: For capital budgeting and cost of capital

Q40: Suppose Tapley Inc.uses a WACC of 8%

Q89: Simplify: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4211/.jpg" alt="Simplify: A)1