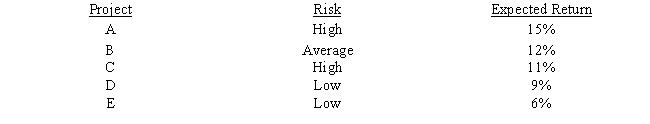

Langston Labs has an overall (composite) WACC of 10%,which reflects the cost of capital for its average asset.Its assets vary widely in risk,and Langston evaluates low-risk projects with a WACC of 8%,average-risk projects at 10%,and high-risk projects at 12%.The company is considering the following projects:

Which set of projects would maximize shareholder wealth?

Definitions:

American Society of Clinical Pathologists

A professional association aimed at providing excellence in pathology and laboratory medicine through certification, education, and advocacy.

American Pharmacists Association

A professional organization that represents pharmacists across the United States, advocating for the profession and patient care.

Family Practitioners

Family Practitioners are medical doctors who provide comprehensive healthcare for individuals and families across all ages, genders, and diseases, focusing on preventative care and chronic disease management.

Internists

Medical doctors specializing in internal medicine, focusing on the diagnosis and non-surgical treatment of diseases in adults.

Q10: Which of the following statements is CORRECT?<br>A)

Q17: Sorenson Corp.'s expected year-end dividend is D<sub>1</sub>

Q17: Lincoln Lodging Inc.estimates that if its sales

Q18: If a firm uses debt financing (Debt

Q18: Because of differences in the expected returns

Q23: Stocks X and Y have the following

Q27: Eakins Inc.'s common stock currently sells for

Q32: Agarwal Technologies was founded 10 years ago.It

Q45: Desai Inc.has the following data,in thousands.Assuming a

Q73: Any cash flows that can be classified