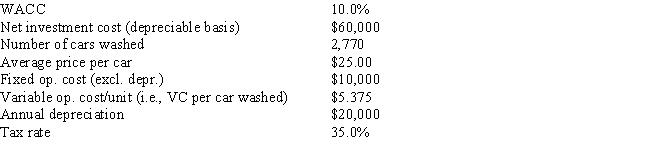

Florida Car Wash is considering a new project whose data are shown below.The equipment to be used has a 3-year tax life,would be depreciated on a straight-line basis over the project's 3-year life,and would have a zero salvage value after Year 3.No change in net operating working capital would be required.Revenues and other operating costs will be constant over the project's life,and this is just one of the firm's many projects,so any losses on it can be used to offset profits in other units.If the number of cars washed declined by 40% from the expected level,by how much would the project's NPV change? (Hint: Note that cash flows are constant at the Year 1 level,whatever that level is. ) Do not round the intermediate calculations and round the final answer to the nearest whole number.

Definitions:

Expected Cost

An estimate of the cost for a product, project, or operation that is anticipated under normal conditions.

Sell

The act of giving or handing over something in exchange for money.

Contribution Margin

The difference between sales revenue and variable costs, indicating how much revenue contributes to covering fixed costs and generating profit.

Relevant Range

The range of activity within which the assumptions about fixed and variable cost behaviors are valid.

Q3: Which of the following statements is CORRECT?<br>A)

Q14: Which of the following statements is CORRECT?<br>A)

Q17: Sorenson Corp.'s expected year-end dividend is D<sub>1</sub>

Q17: Kosovski Company is considering Projects S and

Q26: Spontaneously generated funds are generally defined as

Q58: Which of the following statements is CORRECT?<br>A)

Q61: Stocks A,B,and C all have an expected

Q70: Your company,CSUS Inc. ,is considering a new

Q72: Bill Dukes has $100,000 invested in a

Q78: Suppose you are the president of a