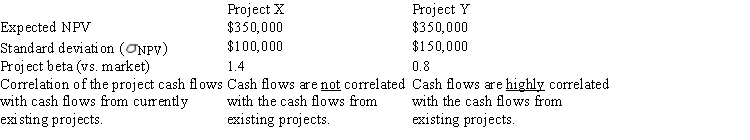

Taussig Technologies is considering two potential projects,X and Y.In assessing the projects' risks,the company estimated the beta of each project versus both the company's other assets and the stock market,and it also conducted thorough scenario and simulation analyses.This research produced the following data: Project X

Project Y

Expected NPV

$350,000

$350,000

Standard deviation (  NPV)

NPV)  $100,000

$100,000

$150,000

Project beta (vs.market)

1) 4

0) 8

Correlation of the project cash flows with cash flows from currently existing projects.

Cash flows are not correlated with the cash flows from existing projects.

Cash flows are highly correlated with the cash flows from existing projects.

Which of the following statements is CORRECT?

Definitions:

Nursing Goal

Objectives or desired outcomes of nursing care, planned in collaboration with the patient, to address specific health needs.

Patient's Story

The narrative recounting of a patient's health history and experiences as related to their physical and emotional wellbeing.

Meaning of Illness

An individual's personal perception and cognitive interpretation of their health condition, affecting their coping strategies and health behaviors.

Listening

A cognitive process involving giving one's attention to audio or signals, often to understand spoken language or music.

Q1: If a firm sells on terms of

Q11: LIBOR is an acronym for London Interbank

Q16: On January 1st Julie bought a 7-year,zero

Q24: The first,and most critical,step in constructing a

Q25: Daves Inc.recently hired you as a consultant

Q30: Kale Inc.forecasts the free cash flows (in

Q45: Which of the following statements is CORRECT?<br>A)

Q53: Taussig Technologies is considering two potential projects,X

Q78: Gupta Corporation is undergoing a restructuring,and its

Q102: Westchester Corp.is considering two equally risky,mutually exclusive